Europe is on the brink of one of the biggest shifts in digital verification infrastructure this decade. Regulators across the European Union are rolling out a harmonized digital identity framework commonly referred to as the EU Digital Identity Wallet for citizens and legal entities. It is designed to standardize how identity and business credentials are stored, presented, and verified across borders. Source: European Commission Official Website.

This is not a pilot concept. The framework emerges from the revised eIDAS 2 regulation and related EU Digital Identity initiatives. Member States are expected to make certified digital identity wallets available by around 2026, with regulated sectors gradually required to recognize and accept wallet-based credentials according to implementation timelines and sector rules.

In practice, this signals a directional shift away from repeated document uploads and scanned PDFs toward cryptographically verifiable credentials that can be validated across systems using shared standards.

You can read the full official press release here.

What is the EU Business Wallet?

The EU Business Wallet is a regulated digital identity framework under eIDAS 2 that allows businesses to store, present, and verify cryptographically secure credentials across the European Union without repeatedly submitting documents.

This means compliance is shifting from optional efficiency to baseline market operation in Europe. If your platform issues, verifies, or uses credentials for identity, licensing, representation or compliance purposes, you’re about to enter an era where digital credentials are not a nice-to-have, but a mandated interoperability layer across public and private ecosystems.

That’s where Hyperstack’s feature set aligns tightly with what this new regulatory landscape demands:

- Reusable Verifiable Credentials that are compliant with the latest structural standards.

- Credential registries and verification APIs that make cross-border trust checkable in real time.

- Role and representation claims built into identity frameworks, making authenticated corporate authority reusable and portable.

- Interoperability built around cryptographic anchors, not fragile PDFs or siloed databases.

In practical terms, this means organizations using platforms like Hyperstack that already support verifiable credentials, cryptographic verification, and structured credential schemas are well positioned to align with the EU Digital Identity Wallet ecosystem. Full interoperability depends on adopting the EU common specifications, trust frameworks, and verification rules as they are finalized and implemented.

Throughout this blog we unpack the essentials of the EU Business Wallet concept, what it means for credential infrastructure, and how Hyperstack’s platform meets that moment with clarity.

What the EU Business Wallet Actually Changes (Beyond the Name)

Every few years, Europe announces a new digital framework that promises to “simplify things.” Most of the time, that simplification shows up slowly, in pieces, and with a fair amount of paperwork attached.

The EU Business Wallet feels different.

Not because it is louder. It is actually arriving very quietly. But because it touches something foundational that most platforms have been postponing a decision about for years: how business identity, authority, and proof should really work.

If your platform issues credentials, verifies them, or relies on them in any way, this change is not theoretical. It is structural. And once it becomes operational, it will feel obvious in hindsight.

On paper, the EU Business Wallet sounds like another digital container. Another place to “store things.” Europe has launched enough of those for everyone to be understandably skeptical.

But this one does something different. It changes how proof works.

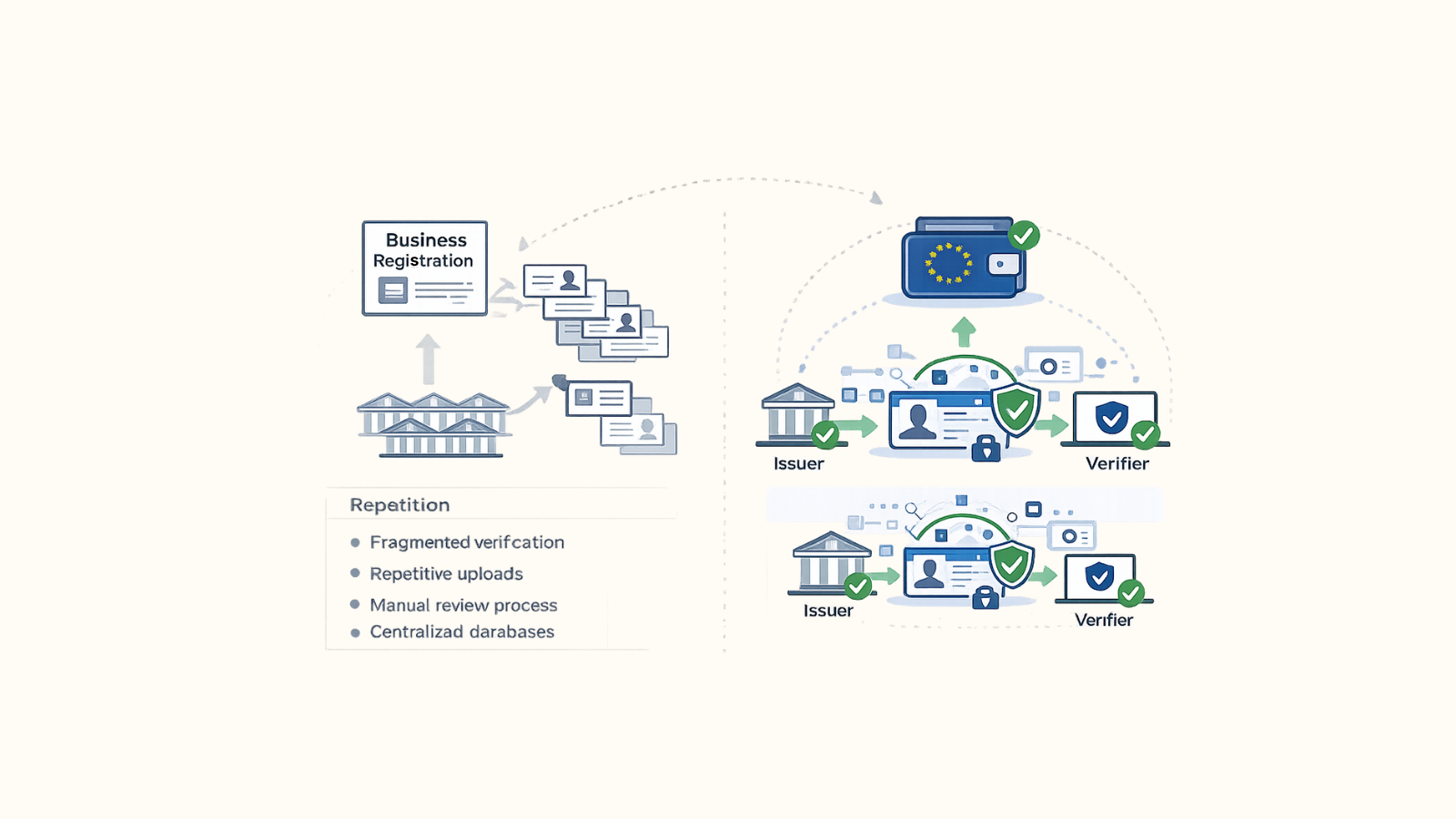

Today, most business verification is still a ritual of repetition. You upload the same registration certificate to five platforms. Each one squints at it differently. Someone on the other end approves it manually, or doesn’t, or asks you to upload it again because the file name looks odd.

Everyone knows this is inefficient. Yet, everyone keeps doing it anyway.

The Business Wallet cuts straight through that loop. Instead of passing around documents, businesses carry verifiable claims. These claims are issued once, anchored to a trusted authority, and checked cryptographically at the moment they’re needed. No rescanning. No reinterpretation. No “could you resend that in a different format?”

That sounds technical. In practice, it feels very simple. Either a claim verifies, or it doesn’t.

And that simplicity is exactly where many platforms will feel friction.

If your system treats credentials as files that sit in storage, this shift is uncomfortable. If your system treats credentials as living objects with issuers, schemas, and verification logic baked in, you're on the right path.

Hyperstack falls into the second camp. Credentials are designed to be issued once, reused often, and verified anywhere. They are not precious artifacts that need guarding. They are functional proof, meant to travel.

As digital identity wallets become a standard interface for business identity across the EU, platforms built around portable, verifiable credentials will adapt more easily to the new requirements than document-centric systems.

For credential platforms, this transition is not about features. It is about assumptions.

Many systems today assume credentials are:

- Uploaded artifacts

- Stored centrally

- Interpreted by the platform itself

- Verified through internal logic

That model works in closed ecosystems. It struggles in open, regulated ones.

The Business Wallet assumes something else entirely. Credentials must be:

- Issued with clear authority

- Verifiable without platform-specific trust

- Portable across systems

- Revocable and updatable without reissuance chaos

This is where the gap begins to show.

Platforms that treat credentials as static files will need workarounds. Platforms that treat credentials as structured, verifiable objects will feel far less friction.

This is the architectural reality of systems in 2026.

What Happens at Scale

This is where it helps to step away from theory.

After issuing roughly two million credentials across different use cases, something becomes very clear. The hard part is not issuing credentials. The hard part is managing what happens after issuance.

At small volumes, inconsistencies hide.

At large volumes, they surface immediately.

We saw credentials that were technically valid but practically unusable because they could not be verified outside a single system. We saw credentials that required constant reissuance because updates could not be reflected cleanly. We saw verification flows that worked beautifully until they were exposed to a second or third relying party.

None of these were catastrophic failures. They were death-by-a-thousand-cuts problems.

What scaled well were credentials that were:

What scaled well were credentials that were:

- Clearly structured

- Explicit about issuer authority

- Easy to verify independently

- Designed to be reused

Those patterns align almost perfectly with where EU regulation is heading. Not because anyone predicted it, but because scale forces systems to upgrade to a tighter credential stack.

Why Interoperability Is No Longer a Nice Word

For years, interoperability has been treated as a future concern. Something to add after growth. Something to solve with partnerships and integrations.

The Business Wallet reframes it as a baseline expectation.

Credentials are expected to work across systems that do not coordinate with each other. Verification is expected to succeed without prior agreements. Trust is expected to be embedded in the credential itself, not negotiated externally.

That changes the economics of platform design.

If your credential only works when someone understands your system, it is fragile. If it works because it conforms to shared standards, it is resilient.

Hyperstack’s credential model is designed around portability and independent verification rather than platform-locked validation. That architectural direction aligns well with how EU wallet and verifiable credential frameworks are evolving, provided the required common specifications and trust mechanisms are implemented.

This matters more now than it did even a year ago.

Another Personal Note: Where Teams Usually Get Stuck

When teams start preparing for wallet-ready infrastructure, the first instinct is often technical.

“What standards do we support?”

“What APIs do we need?”

“What integrations are missing?”

Those questions matter, but they are rarely the real blockers.

What usually slows teams down are softer questions:

- Who is actually authorized to issue this credential?

- What happens when that authority changes?

- How do we handle updates without breaking the existing trust?

At small scale, these questions are answered informally. At regulatory scale, they must be explicit.

One of the unexpected benefits we saw after large-scale issuance was clarity. When authority and structure are built into credentials, internal processes become cleaner. Fewer exceptions. Fewer manual overrides. Fewer “just this once” decisions.

Regulation often gets blamed for friction. Sometimes it just exposes existing ambiguity.

What “Compliance” Looks Like in Practice

Compliance in this context is not about ticking boxes. It is about alignment.

Aligned credentials will,

- Match recognized schemas

- Declare issuer authority clearly

- Support independent verification

- Handle lifecycle changes cleanly

Aligned platforms,

- Do not rely on private trust shortcuts

- Avoid locking credentials inside dashboards

- Treat verification as a shared process, not a proprietary one

This is where Hyperstack’s current approach maps well in principle.

Credentials are issued to be used elsewhere. Verification can be designed to succeed even when Hyperstack is not part of the runtime flow, when credentials follow shared verifiable credential standards and accepted trust anchors.. Authority is explicit, not implied.

That design choice feels conservative until regulation rewards it.

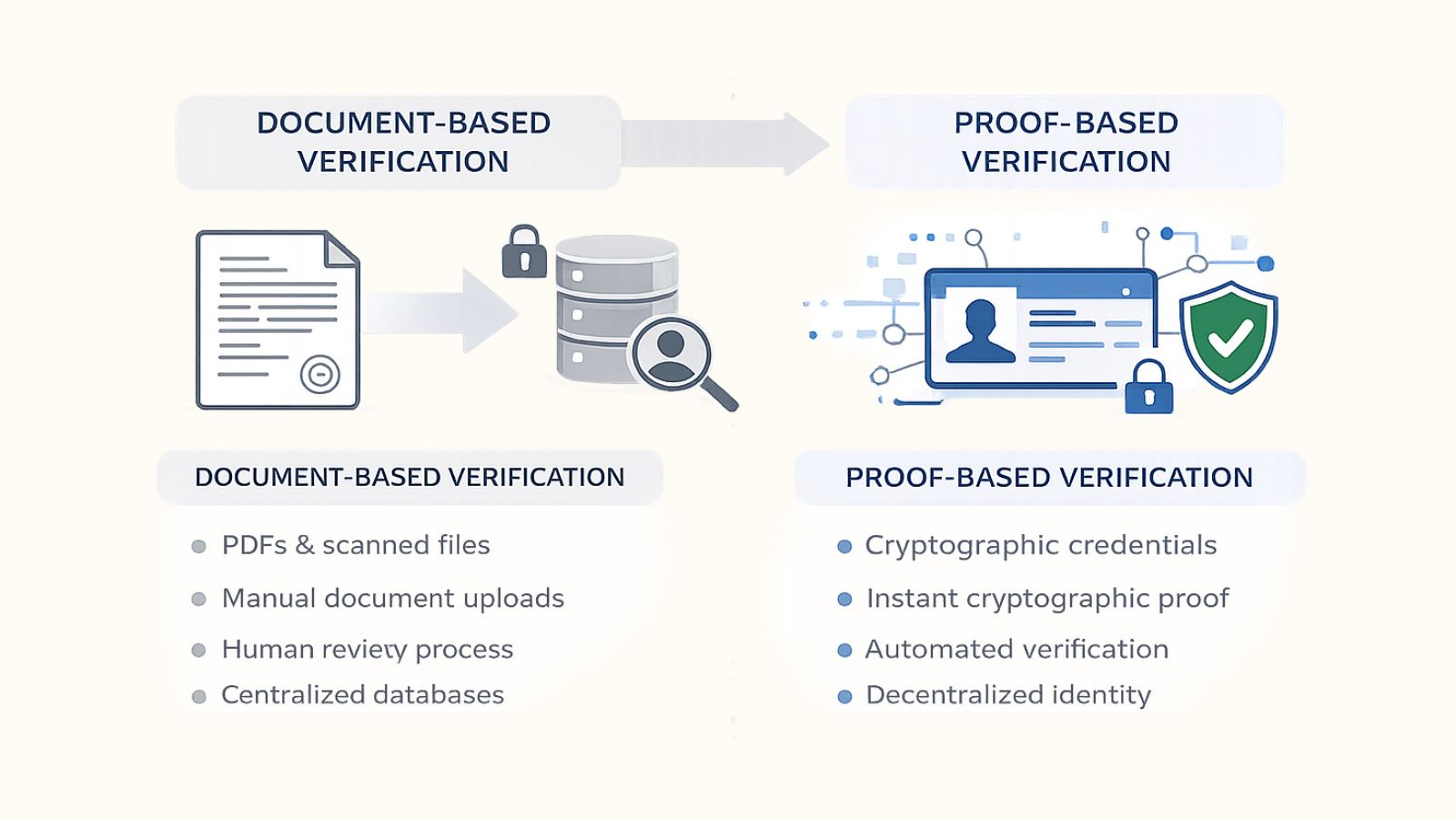

The Shift From Documents to Proof

One of the hardest habits to break is thinking in documents.

Documents feel concrete. They look official. They can be opened and inspected. They also degrade quickly in digital environments.

Proof behaves differently.

Proof can be checked instantly.

Proof does not need interpretation.

Proof does not care about file formats.

The Business Wallet accelerates this shift. And once businesses get used to it, they will expect it everywhere.

Credential platforms that continue to center workflows around documents will feel increasingly out of step. Not wrong. Just dated.

Preparing Without Turning It Into a Project

Not every organization needs a transformation initiative.

Preparation can be incremental:

- Audit which credentials you issue

- Clarify issuer authority

- Ensure verification works independently

- Design for reuse rather than resubmission

These steps do not require urgency theatre. They require attention.

Hyperstack supports this kind of preparation without forcing a single migration moment. Teams can modernize gradually while staying aligned with regulatory direction.

That is often the healthiest way to adapt.

One Last Observation From the Field

The most interesting thing we noticed after large-scale credential issuance was not technical. It was behavioral.

Once people trust that a credential will verify anywhere, they stop hoarding copies. They stop asking for backups. They stop screenshotting “just in case.”

Trust changes behavior faster than policy ever could.

The EU Business Wallet is trying to institutionalize that trust. Not through persuasion, but through structure.

Platforms that understand this will not need convincing later.

A Practical Note on Wallet Interoperability: EU Digital Identity Wallet interoperability is driven by common technical specifications, trust lists, and sector-level rules. Any credential platform must implement those specifications and verification methods to achieve production interoperability. Existing capabilities such as GDPR controls, SOC 2 practices, and verifiable credential issuance are strong prerequisites, but formal alignment requires technical mapping and, in some cases, conformance processes.

Closing Thoughts

The EU Business Wallet will not arrive with fanfare. It will arrive through requirements, defaults, and quiet expectations.

Some platforms will experience it as disruption. Others will experience it as confirmation.

If your credential infrastructure already assumes portability, independent verification, and explicit authority, this shift will feel natural. If it does not, the pressure will arrive gradually, then suddenly.

Hyperstack exists in that first category. Not because it was built for regulation, but because it was built for scale and reuse. Regulation is simply catching up.

When the wallet becomes ordinary, readiness will stop being visible. It will just feel like things work the way they should.

And that is usually the goal.

FAQ Section

1. What is the EU Business Wallet?

The EU Business Wallet is a regulated digital identity framework under eIDAS 2 that allows businesses to store, present, and verify cryptographically secure credentials across the European Union without repeatedly submitting documents.

2. Is the EU Business Wallet mandatory for businesses?

The EU Digital Identity Wallet will be provided by Member States. Acceptance requirements apply mainly to regulated services and specific sectors under eIDAS 2 and related rules. Not every private service is automatically required to accept wallet credentials in every scenario.

3. When does the EU Business Wallet come into effect?

EU Member States are expected to make certified digital identity wallets available around 2026, with phased recognition requirements following according to sector regulations and implementation schedules.

4. What types of credentials will be used in the EU Business Wallet?

The EU Business Wallet relies on verifiable credentials, which are cryptographically signed claims issued by trusted authorities and designed for instant, independent verification across systems.

5. How is the EU Business Wallet different from uploading documents?

Instead of uploading PDFs or scanned certificates, the EU Business Wallet allows businesses to share verifiable proof that can be checked automatically, without manual review or repeated submission.

Credential platforms will need to support interoperable, verifiable credentials that can be issued, verified, updated, and revoked independently of proprietary systems or manual trust processes.

Platforms that issue or verify credentials used in regulated EU identity contexts will need to align with eIDAS 2 technical and trust framework requirements. The exact obligations depend on their role as issuer, verifier, or relying party.

Platforms can prepare by auditing issued credentials, clarifying issuer authority, supporting independent verification, and designing credentials to be reusable rather than platform-bound.

9. Will the EU Business Wallet replace existing verification systems?

The EU Business Wallet will not immediately replace all systems, but it will increasingly become the default method for business identity verification in regulated and cross-border EU interactions.